XrossGlobal Financial

AI & Fintech solutions for Financial Institutions

Risk Management solutions

Process Automation

AI solutions for Process Automation & Risk Management

Financial institutions are facing the following challenges;

We leverage AI to build next generation Risk Management systems to meet these challenges.

- Difficulty finding the right number and quality of Line 1 Risk Specialists to manage the risks owned by the Line of Business.

- Risk management systems that are not user friendly enough for non-Risk professionals who are often tasked with documenting risk information.

- Incomplete controls – No benchmark of “expected key controls” for a given risk and not considering End-to-End controls for a Transactions Lifecycle across a Value-chain.

- Inconsistent Control Operation due to a lack of automation.

- Insufficient awareness or co-ordination of Data Risks and IT Systems Risks within the Operational Risk frameworksd due to out-dated siloed approaches.

- We make Risk Management faster, simpler & more compliant with Regulatory expectations & industry leading practices!

- Our systems are designed with the end-user in mind and we have created automated risk process workflows that guide even people with no formal risk training to manage and document risk tasks like a seasoned Risk Specialist.

- We identify Key Controls that are missing from your Control Environment via automated gap analysis.

- Through AI Agents, we reliably automate Control Performance and do away with unecessary manual controls that are prone to execution errors.

- We promote holistic approaches to Process architecture, Systems architecture and Data Architure /Data Fabric to unify management of Operational Risks coherently across domain perspectives, (People, Processes, Products, IT Systems, Data and Third Party Vendors).

- Documenting a large number of continually evolving Regulatory Obligations that regulated entities need to comply with is a laborious task, prone to errors and omissions.

- Creating and maintaining a complete an upto-date Obligation Register and Compliance Plan is a herculean task, especially for multinational banks that are subject to multiple regulators across various jurisdictions and exposed to large fines for non-compliance.

- Many organisations have a myriad of internal policies that Business Units also need to comply with to stay within approved risk appetite limits.

- We use Artificial Intelligence & Process Automation to create Compliance Obligation Registers/libraries and identify applicable Obligations that are missing from your current Obligation Registers.

- Compliance by design: Our AI Agent systems will recommend generic “expected control” sets based on the type of regulation, (Prudential or Conduct) and create Compliance Monitoring Plans for your Compliance specialist to review and approve for implementation.

- XrossGlobal AI agents can be deployed to monitor the level of compliance with your internal Policies.

- As businesses grow dis-economies of scale occur over time as increased transactions, customers, products, processes, systems and people add complexity. Manual processes and execution error account for about 50% of all operational risk events in financial institutions.

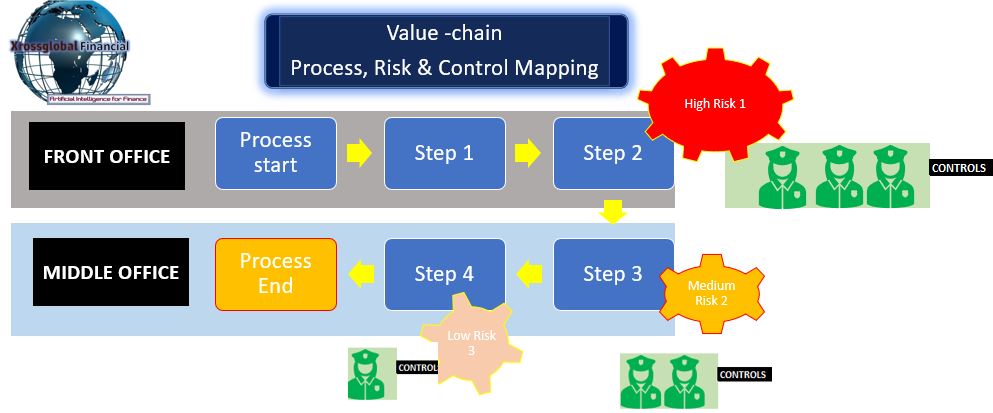

- Value chain process mapping has not yet been widely adopted in the industry but is a key requirement if your are planning to automate your processes and reduce Execution Errors

- Automated Value-chain process mapping with process risks and controls identified.

- Process assessments done to risk rate the Process-At-Risk (VaR concept).

- combining ML with Reverse-stress testing and bow-tie diagrams to produce actionable intelligence and predict points of failure, pinpoint missing controls and take pre-emptive action.

- Workflow automation for the finalized Process Maps.

Data Risk Management & Analytics Dashboard

- Poor quality risk data, inconsistent data hygiene across Lines of Business, including not documenting key controls.

- Inadequate use of Risk objects in widely used Risk systems such as IBM Openpages.

- Failing to harness existing Data repositories/ warehouses containing both Structured and Unstructured data about your Risks & Compliance environment.

Lack of actionable intelligence and predictive insights on the Risk & Control environment.

5. Untimely risk reporting to senior management data and no automated real-time alerts for high-rated incidents.

- Advanced Data Fabric/Management approaches required to support AI adoption; plus AI-powered templates to uplift the data quality of risk objects and drive consistency across Lines of Business.

- We deliver systems that can leverage and enhance your existing Data warehouses containing Customer data, Risk data, Regulatory Obligations, Processes, Systems and Controls data to deliver cost & time savings and better Customer outcomes

- Our systems use IBM Openpages & Machine learning to provide Risk Data analytics and insights on emerging risks.

- We leverage Machine Learning to provide forward-looking predictive analytics that can be used to take pre-emptive action before Incidents occur that impact customers or key processs.

- Real-time Management Alerts and comprehensive Risk Reporting dashboards.

Control room, Trade Surveillance & Communications Monitoring

- Out-dated inadequate surveillance system, that are just “alert factories” and not reliably identifying true conduct anomalies.

- Lack of integrated surveillance alerts which combine Trade Surveillance & Communications Monitoring signals.

- Lack of trader behavioural profiling metrics.

- Surveillance systems driven by Machine Learning to generate quality alerts and reduce false positives.

- Integrated surveillance alerts which combine Trade Surveillance & Communications Monitoring signals.

- Comprehensive trader behavioural profiling metrics & statistical anomaly detection.

RegTech for Regulators to Enforce Fair & Orderly Markets

- Out-dated inadequate surveillance system, that are just “alert factories” and not reliably identifying true compliance anomalies.

- Lack of trader and account behavioural profiling metrics.

- AI enabled Behavioural cluster analysis (based in on the UK FCA approach.)

- Quickly identify anomalous trading behaviours that are statistically significant.

Internal Audit functions

- Audit systems that have Audit workflows and Work papers that are not integrated with Risk Management systems.

- Tools that are not designed to give up-to-date real-time information to mitigate Audit Risk.

- Audit systems that are integrated with your IBM Openpages database but in a segregated Audit environment.

- Realtime updates on the Risk & Compliance profiles of Auditee depts with advanced analytics to identify missing or changed Controls during the Audit.

Risk Management Advisory & Training

- Limited internal resources to deliver Risk Management training

- Need for external independent risk consultancy

- Customised Risk & Compliance Training.

- We can also support your organisation through our Risk Consultancy & Independent Expert advisory service to remediate Audit and Regulatory findings.

Stock Market Screener

Portfolio Risk & VaR

XVA, Market Risk & Counterparty Credit risk

- There are many complicated factors and types of technical analysis to apply to exchange traded products.

- Finding the right balance between risk and reward is difficult.

- There is uncertainty as to how a theoretical investment strategy will work in real-world market conditions.

- Price-sensitive global events that impact your portfolio of investment strategy can occur at anytime and outside business hours of your local exchanges.

- Accurately calculating risk and return includes understanding the risks taken to achieve those risks. Market Risk VaR is not the only consideration. Liquidity and human behaviour are often ignored but have the ability to enduce eye-watering losses.

- Modelling risk-adjusted returns should include close attention to deviations from approved investment strategies, this is often ignored when out-performance occurs but becomes a focus point in the post-mortem review of a Rogue trading scandal.

- Effective XVA decision-making is challenging and requires visibility of pricing factors across risk types which impact CVA, FVA, MVA and KVA calculations. Siloed trading desk organisational structures and differences in data structure/ values across bespoke systems for Credit Risk, Market Risk, FTP and Margining.

- Identifying portfolio compression opportunities to create margin reduction is often a complicated and inefficient task.

- Limited XVA Pricing skillsets

- We provide proprietary technical analysis software for exchange traded products.

- Optimize Risk & Return objectives

- Backtest strategy entry and exit points using actual historical prices and market conditions before risking capital.

- Screen stocks and indices on major global stock market exchanges 24/7.

- Our systems provide portfolio return analytics for money managers and performance attribution against defined benchmarks to measure manager skills and alpha generation.

- We provide proprietary AI models that combine traditional Time-weighted and money-weighted returns with ML approaches for identifying unauthorized trading behaviours.

- We provide tools for risk and reward visualization.

- A centralized XVA Management systems to provide an efficient sales-pricing workflow, to provide competitive and timely response to the client or counterparty pricing quote request.

- XVA pricing Systems that provide clear and transparant cost-benefit for each derivative trade and its contribution to both Pnl and Capital costs.

- Efficient automated identification of portfolio compression opportunities.

A.M.D.G

AI Technologies

Predictive Analytics for Financial Risk Management:

- Machine Learning: Uses historical data to predict future financial risks, identifying potential threats such as fraud or default.

- AI Agents: Continuously monitor financial transactions and alert institutions to unusual patterns, enabling proactive risk mitigation.

- LLMs: Assist in interpreting complex financial data and generating detailed risk reports, enhancing decision-making processes.

Automated Customer Support Systems:

- Machine Learning: Analyzes customer queries and feedback to improve response accuracy and efficiency over time.

- AI Agents: Interact with customers through chatbots or voice assistants, providing instant support and resolving common issues autonomously.

Our Expertise

XrossGlobal has expertise in both Financial and Non-financial risks:

- Regulatory capital

- Market risk

- Liquidity risk

- Counterparty credit risk

- Operational risk

- Compliance

We deliver value-add to :

- Exchanges

- Clearing houses

- Banks

- Brokerages

- Insurance companies

- Other large corporates

IBM Partnership

Access to Cutting-Edge IBM Technology and support:

- IBM Solutions: XrossGlobal, as an IBM reseller under the IBM Partner Plus program, provides financial institutions with access to IBM’s advanced technologies and solutions. These include AI, machine learning, Data Management and Cloud computing, tailored to enhance risk management and automate operations.

- Innovation: By leveraging IBM’s innovative technology and robust platforms, XrossGlobal is able to to add a layer of AI innovation and Risk Management expertise to address process pain points and risk managment issues that financial instituions face.

Our Fintech & Regtech experience.....

Why Choose Us?

XrossGlobal has extensive industry experience in helping large banks uplift their risk processes, systems, data, and overall control environment, typically to remediate regulatory findings and drive digital transformation projects.

Best Industry specific AI Adoption agency

XrossGlobal aspires to be an industry leader in facilitating AI adoption for financial institutions, empowering them to leverage cutting-edge technologies for enhanced efficiency, risk management, and customer engagement.

Adopt AI & Automation at Your Own Pace

XrossGlobal understands that financial institutions are at varying stages of risk management sophistication and AI adoption; we will work with each organisation to provide tailored proof of concept demos that address their specific needs.

Testimonials

Trusted by Banks and other Financial Institutions

Emma Hart

Eddie Johnson

Jonathan Doe